Real time player data often feels decisive. Numbers update instantly. Dashboards refresh continuously. Teams feel pressure to react at the same speed. The risk is rarely missing information. It is assigning meaning before patterns have had time to form.

In the current Steam ecosystem, steam concurrent players by game is often treated as a performance verdict. Spikes are read as success. Drops trigger concern. In reality, CCU functions as a heat signal. It shows where attention concentrates at a specific moment, not why it formed or how long it will persist.

This guide explores how concurrent player data should be interpreted as a market signal, how to distinguish structural movement from temporary noise, and how real time CCU can support competitive understanding without turning analytics into prediction.

CCU Spikes & Discovery Boost

Sharp CCU spikes are usually driven by discovery events. Featuring, front page exposure, free weekends, or external traffic sources can all concentrate attention quickly.

The mistake is assuming that every spike reflects durable demand. In many cases, it represents curiosity rather than commitment. Players arrive to explore, not necessarily to stay.

Steam concurrent players by game becomes meaningful only when the post spike baseline is observed. A rapid return to previous levels often signals discovery driven traffic. A higher stabilized floor suggests that expectations and experience are aligning. The signal is not the peak. It is what remains after visibility fades.

Live Content Impact (Streams & Updates)

Live content produces a different CCU dynamic than standard discovery.

Streams expose gameplay systems without editing or framing. Updates re engage existing players while also attracting new attention. Both can concentrate activity, but neither guarantees retention.

When CCU rises during a stream or immediately after an update, interpretation should focus on follow through. Do players return the following day. Does the curve stabilize above its previous baseline. Or does activity dissipate entirely.

CCU during live moments is directional, not conclusive. Its value emerges only when similar patterns repeat across multiple cycles.

Gradual vs Sudden Decline Patterns

Decline does not carry a single meaning. Gradual decline often reflects natural lifecycle movement. Content completion, saturation, or routine fatigue typically produce smooth tapering. Sudden drops are more likely to indicate friction, unmet expectations, or attention being pulled elsewhere by competing releases.

The distinction becomes clear only through repetition. One day movement rarely provides sufficient signal. Consistent shape changes across time are what indicate structural shift.

Reading CCU as a curve rather than a snapshot allows teams to separate healthy normalization from emerging risk.

How to Read Real Time CCU Signals With Datahumble

Real time data moves faster than understanding. Datahumble helps teams interpret CCU behavior by placing real time movement alongside comparable titles, genres, and lifecycle stages. This context reduces the impulse to react to isolated fluctuations.

Instead of asking whether CCU is rising or falling, teams can evaluate whether the behavior matches expected patterns for similar games under similar conditions. Datahumble supports interpretation, not prediction. It helps teams understand what CCU signals resemble, not what they guarantee.

This framing keeps real time data informative without turning it into pressure.

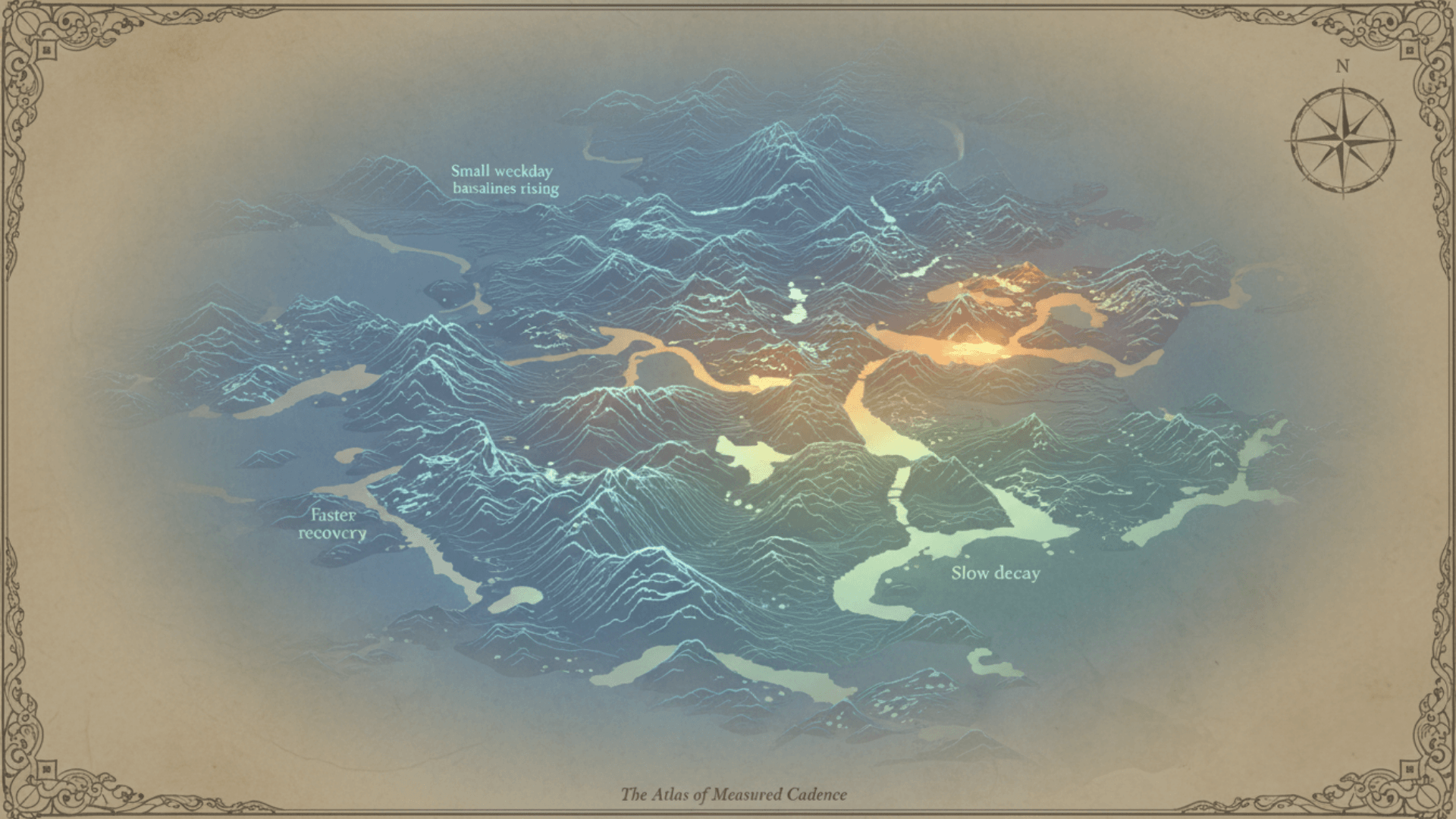

Finding Hidden Growth Potential

Not all growth announces itself with spikes. Some games strengthen quietly. Slightly higher weekday baselines. Faster recovery after dips. Slower decay following updates. These changes often appear before more visible momentum elsewhere.

Hidden growth emerges when attention settles rather than surges. It is easy to overlook when focus remains fixed on peaks. By observing steam concurrent players by game across longer windows, teams can identify early reinforcement before it becomes visible in revenue or reviews.

Weekday vs Weekend Trends

Daily rhythm reveals how players integrate a game into their routines.

Weekend heavy CCU often reflects sampling behavior. Strong weekday presence suggests habit formation. A game that holds attention midweek behaves differently from one driven primarily by weekend curiosity.

Comparing weekday and weekend patterns helps teams understand whether engagement is casual or embedded. CCU viewed through this lens shows how attention fits into real world schedules rather than promotional cycles alone.

FAQ: CCU & Revenue Correlation?

- Does higher CCU always translate into higher revenue?

Not necessarily. CCU reflects presence, not purchasing behavior. - Can CCU drops signal future revenue decline?

Sometimes, but only when patterns repeat consistently. Isolated drops are rarely decisive. - Is CCU more valuable than sales data?

It is earlier, not stronger. CCU shows behavior while decisions are still forming. - How often should CCU be monitored?

Often enough to observe trends, not so often that noise drives reaction.

For foundational definitions of concurrent player metrics and how they relate to other performance indicators, see “Steam Game Statistics Unlocked: Numbers That Build (or Break) Your Game.”

Reading Market Heat Without Overreaction

Concurrent player data shows where attention concentrates right now. It does not explain intent, satisfaction, or outcome on its own.

When teams treat steam concurrent players by game as a heat signal rather than a verdict, analysis becomes calmer and more reliable. Patterns replace panic. Context replaces reaction.

Datahumble helps teams interpret real time CCU movement alongside historical behavior and peer benchmarks, supporting clearer understanding of what market attention is actually doing. The advantage comes not from reacting fastest, but from interpreting most carefully.